Turn up the pay on payday.

The first automated savings solution that rewards your employees for achieving their financial goals.*

The first automated savings solution that rewards your employees for achieving their financial goals.*

Money is the #1 source of stress for Americans.

Financial wellness programs are the #1 requested workplace benefit.

75% of workers say financial stress impacts their productivity.

No HR or payroll integration required

Getting started is easy and quick – employees enter a few details and they’re ready to go.

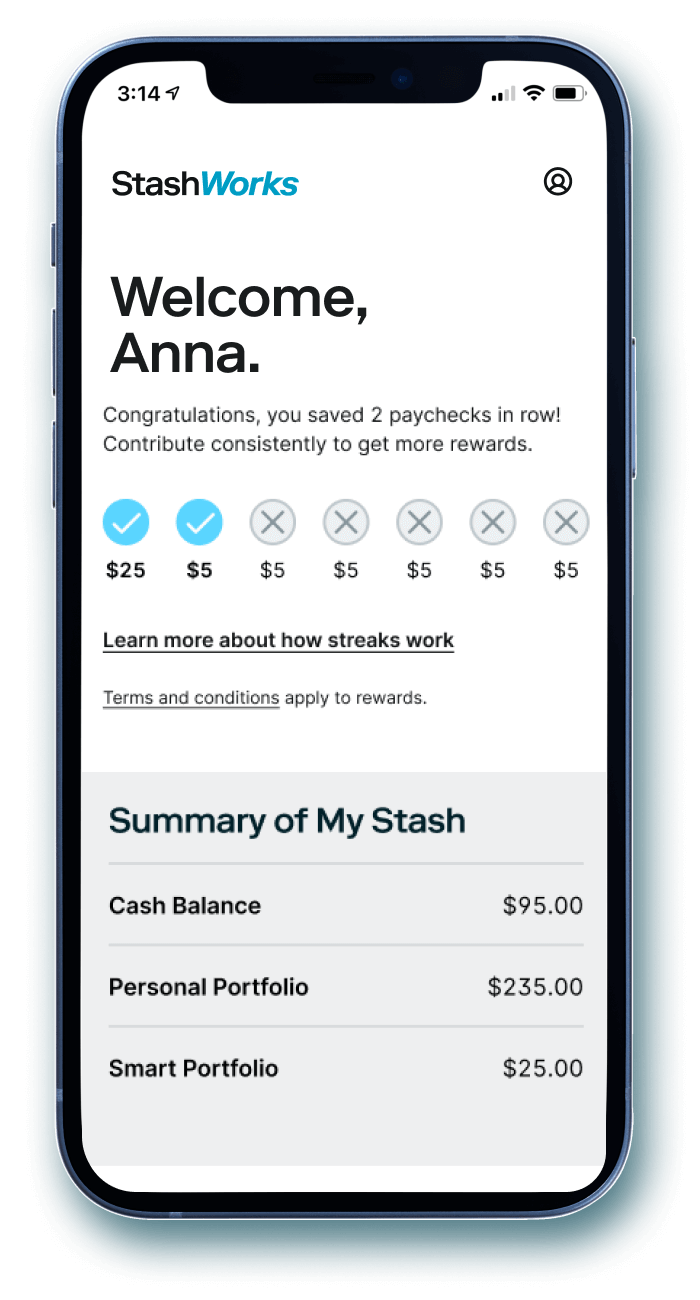

Employees earn cash in a Stash Smart portfolio to reward them for reaching financial milestones.7

Automated contributions help employees build their finances consistently.

Employees gain confidence and financial knowledge with engaging content and expert guidance.

Connect with the StashWorks team today to learn more about our automated financial solutions.

Get in TouchStashWorks is a workplace benefit that makes it easy and rewarding for employees to save money and achieve their financial goals. With StashWorks, employees can:

By combining the power of financial education with actionable solutions, StashWorks helps employees improve their wellbeing today and plan for the future.

Stash partners with employers across a spectrum of industries and is designed to support diverse teams, employees at all life stages and a range of employment statuses, including FT, front line, corporate, hourly, PT, and 1099 workers.

For most people, saving money feels hard or out of reach. This lack of savings creates stress that affects their physical and mental health as well as their productivity as employees.

StashWorks solves this problem - simply put, we make it easy and attractive for employees to automatically contribute to their financial wellbeing through paycheck contributions. In exchange for enrolling in Stash and consistently contributing as little as a few dollars each week, they receive cash rewards.

StashWorks is also designed to be easy for employers - offering the benefits requires no integration or ongoing administrative burden and employees can sign up on their own in minutes. By giving employees access to saving solutions, financial education and perks such as a pay day that’s up to 2 days early3 and no hidden fee banking2, StashWorks does not compete or replace a 401k program and instead is built to complement existing workplace financial benefits.

The process is easy: after signing our agreement, StashWorks partners with you to send your employees an invitation to enroll in the benefit via email. Employees can opt in, sign up and open their Stash account in minutes.

We’d love to connect with you and get your company onboarded. Please contact us here and we will be in touch shortly.

As a registered investment advisor, Stash provides personalized investing guidance and financial education based on each users’ goals and risk level as soon as your employee opens a brokerage account. StashWorks does not, however, provide live, one-on-one access to financial advisors, planners, or wealth managers.

Every employer will be able to contribute cash to their employees’ Stash rewards. We are developing the functionality to support employer-sponsored rewards in the near future, addressing the unique legal and compliance obligations for each business.

Yes. We encourage employees to reach out to us directly for all StashWorks-related questions. Our customer service team is available via email or phone from 8:00 a.m.-8:00 p.m. ET Monday-Friday In addition, employers and employees are provided with training guides and sessions, including FAQs and our online customer service portal.

Stash is not currently authorized to serve customers residing outside of the U.S. Only employees with a SSN can enroll in StashWorks.

It depends on the Stash products the employee is using. Stash Retirement and Custodial accounts have special restrictions. For transfers out of these accounts, our Customer Service team will work closely with employees by phone or email to process transfers.

Employees can withdraw and spend money from Stash Banking using their Stash Stock-Back® debit card1 - at ATMs globally, for purchases or for online transactions.

Funds transferred externally from Stash Banking or Investment accounts will be removed from their Stash account almost immediately. It may take up to three business days for the funds to appear in their external bank account, depending on the time the request was made.

Funds from an investment sale will take two business days to settle. They should be available to transfer internally to another Stash account (e.g. Stash Banking) or externally on the third business day.

We hold recent deposits for up to five business days to protect our clients from fraud. These funds will be available to transfer within six business days.