Stash makes saving money easy, fun and rewarding for millions of customers.

On StashWorks, you can automatically put money into a saving solution, instantly access your funds in case of an emergency, and take unlimited advantage of a wealth of financial content and guidance to build confidence and good habits along the way.

There are no account minimums or hidden fees1 - get started on your savings journey with as little as $5.

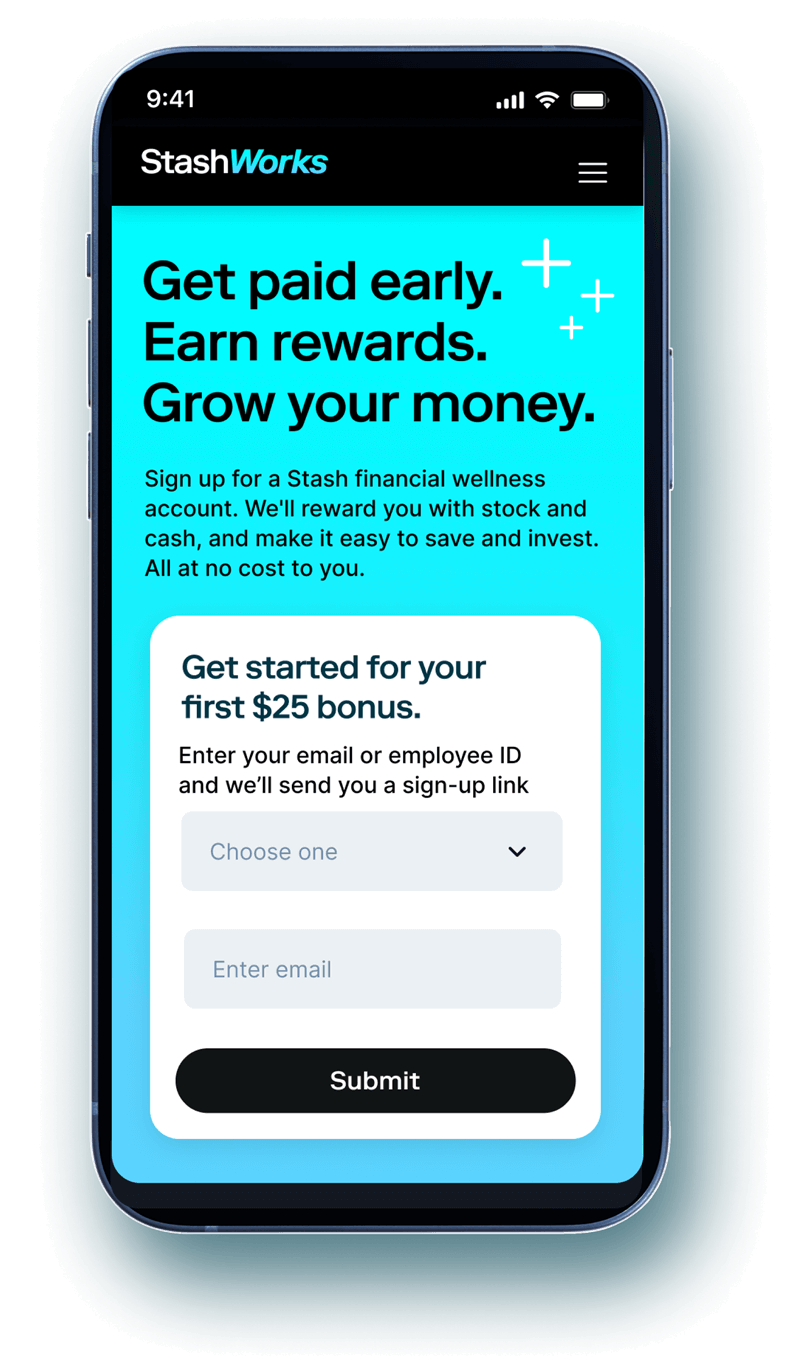

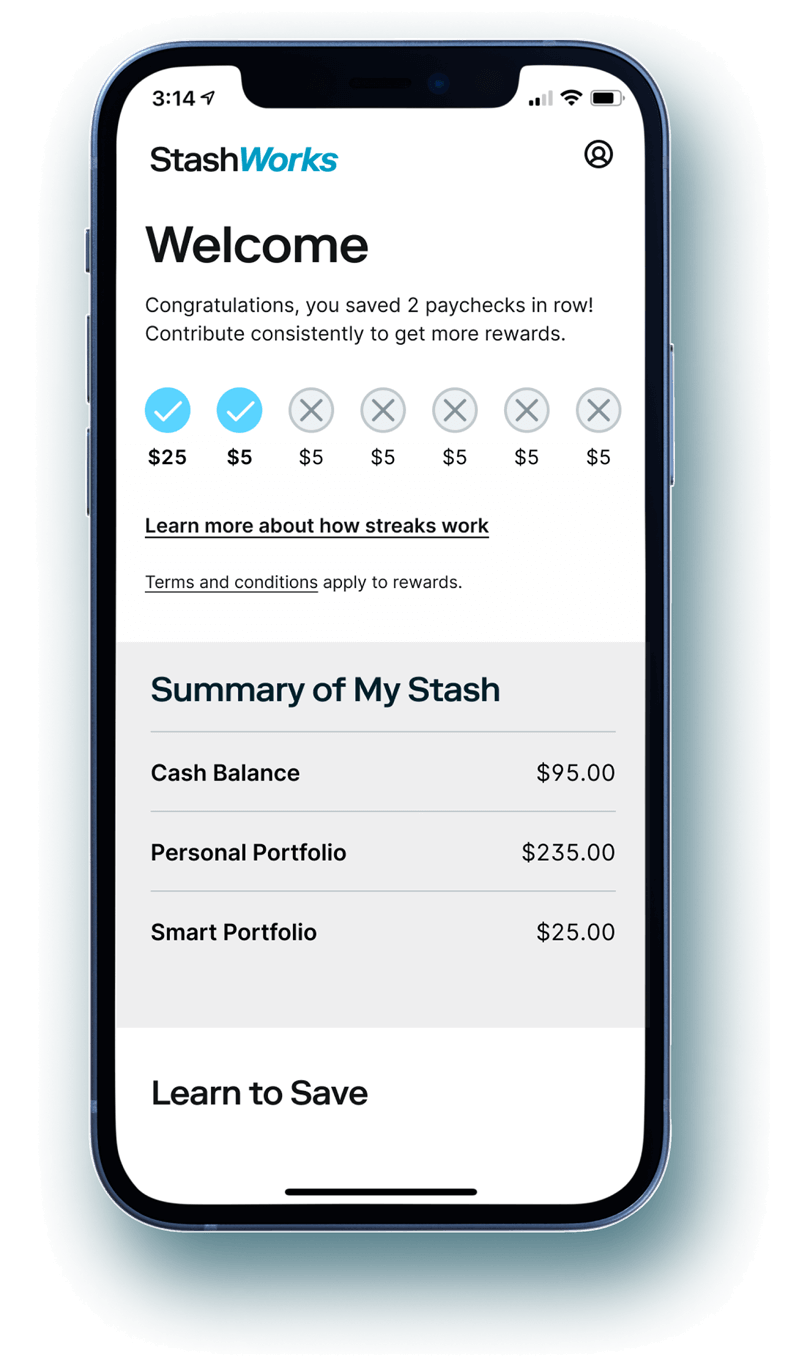

The best part? Stash gives you cash rewards when you make consistent contributions (no deposit minimum) to your account directly from your paycheck. You will earn $25 when you open your Stash account and make your first deposit. Learn more about rewards’ terms here. Sign up in minutes today and get paid to save.

StashWorks is designed to help reduce stress and improve your financial well-being now and in the future.

Automated investing and saving - no minimums, no hidden fees†

Get paid up to two days early3

Cash rewards when you save as little as $5 from your paycheck

Cash rewards when you save as little as $5 from your paycheckInstant withdrawals in case of an emergency